Table of Content

A good FICO score is key to getting a good rate on your FHA home loan. Here is some of the documentation you will need when applying for an FHA home loan.

This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Refinance a mortgage, can use an FHA loan as long as they meet the eligibility requirements. If you are using a state or local assistance program to obtain an FHA loan, that program may have its own income limits and requirements.

Important FHA Guidelines for Borrowers

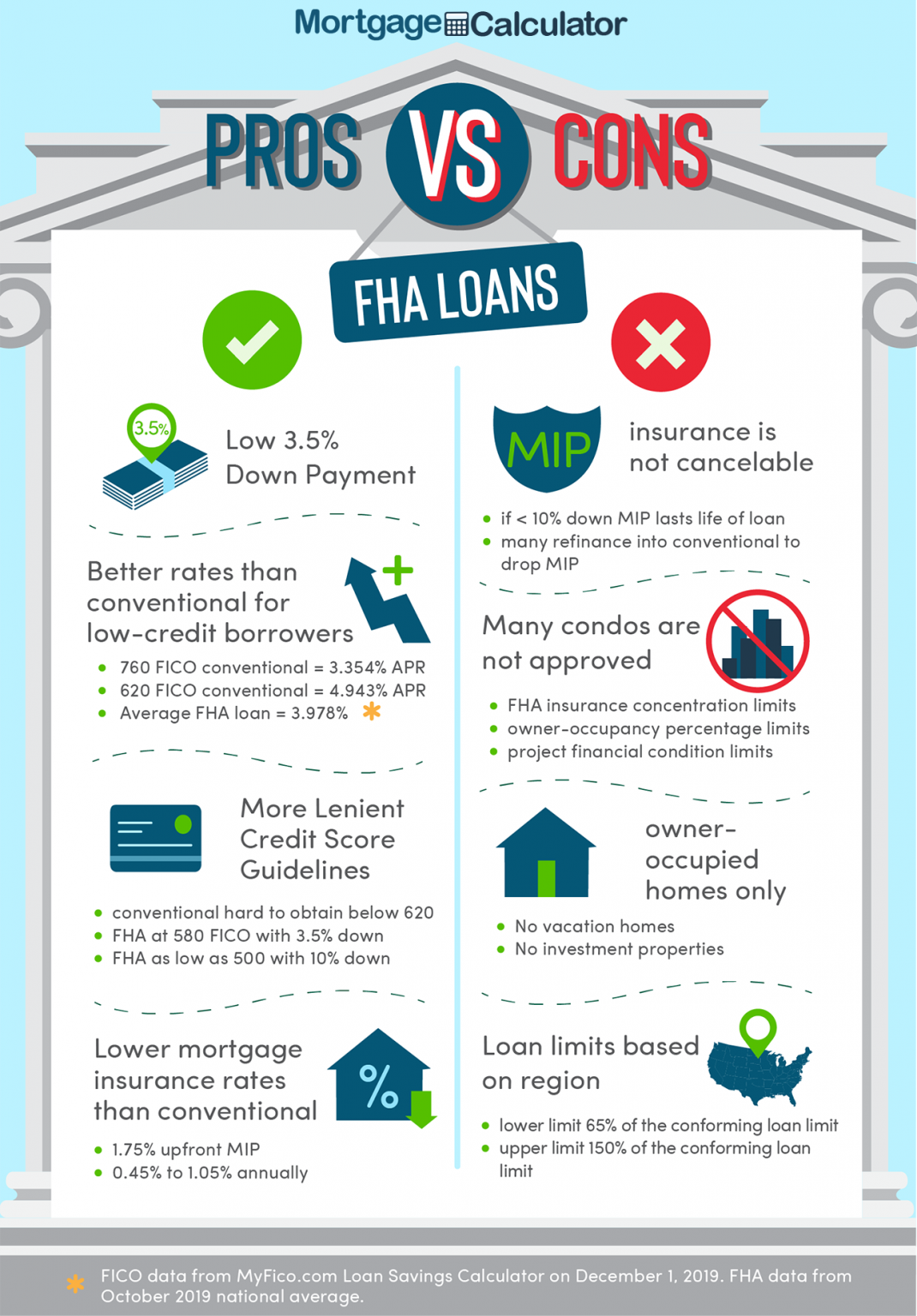

Conventional loans usually require the borrower to carry Private Mortgage Insurance if borrowers don't provide a minimum 20% down payment. FHA mortgages are different and require the payment of an Up Front Mortgage Insurance Premium and an annual Mortgage Insurance Premium . FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages. This article provides a very basic overview of FHA eligibility requirements in 2017. It is based on the minimum guidelines established by the Department of Housing and Urban Development, which oversees the FHA mortgage insurance program.

For customers with a credit score of less than 680, FHA rates are usually cheaper than conventional rates. The influence of credit score on mortgage rates is greater than the impact of loan type. New FHA policy requires a minimum credit of 500 to buy a house.

Benefits of an FHA Loan

The lender must obtain written documentation of the deferral of the liability from the creditor and evidence of the outstanding balance and terms of the deferred liability. The lender must obtain evidence of the anticipated monthly payment obligation, if available. In fact, even if you have had credit problems, such as a bankruptcy, it's easier for you to qualify for an FHA loan than a for a conventional loan. Credit scores down to 500 are accepted if there are compensating factors that offset the credit risk.

The new handbook for FHA loans took effect in September of last year, and it’s now the “law of the land” for the government-insured mortgage program. That means if your situation doesn’t neatly fit within all the guidelines, a lender may consider your loan application as a one-off instance, an exception. Of course, there are other stipulations — remember the handbook is 1,009 pages — but an FHA-approved lender will walk you through the details if other requirements apply to you. FHANewsblog.com is a digital resource that publishes timely news, information and advice concentrating on FHA, VA and USDA residential mortgage lending. We offer a full video library on the definitions of many basic mortgage terms.

Collections, Judgments, and Federal Debts

FHA insured mortgages are generally not available to borrowers whose property was foreclosed on or given a deed-in-lieu of foreclosure within the previous three years. However, if the foreclosure of the borrower's main residence was the result of extenuating circumstances, an exception may be granted if they have since established good credit. This does not include the inability to sell a home when transferring from one area to another. FHA-approved lender; the Federal Housing Administration isn't directly involved.

FHA guidelines allows a borrower with a minimum credit score of 580 to buy a home using their own funds or the funds can be a gift from a family member. FHA requirements are structured so that loan applicants who have a good credit history will likely be eligible for the mortgage. Late payments, bankruptcies, no credit history, and foreclosures will adversely affect your chances. You'll be required to make an upfront mortgage insurance premium equal to 1.75% of the loan amount at closing, though this can be rolled into the loan. After that, you'll make monthly mortgage insurance payments. If your down payment is 10% or more, you'll have to make these payments for 11 years.

In general, FHA rates of interest are among the most affordable, but they don't always have reduced interest rates. Borrowers with credit scores 580 and above can pay as little as 3.5 percent down. Homebuyers can secure an FHA-backed loan with as little as a 3.5 percent down payment.

And up to 85% cash out refinance with a credit score above 580. "FHA's standard underwriting criteria is rolled up into a 'scorecard' that considers many factors related to income and debt," Sullivan says. "Under certain conditions, particularly when a borrower doesn't fit into our general scorecard requirements, a manual underwriting is required." FHA.com is a privately owned website, is not a government agency, and does not make loans. But an FHA-insured loan is not the only low-down-payment alternative. If you are serving or have served in the military, you may qualify for a loan backed by the Department of Veterans Affairs.

Generally speaking, FHA loans are available to borrowers who have credit scores of 500 or higher, and a down payment of at least 3.5%. But mortgage lenders can, and often do, set their own guidelines as well. And sometimes the lender’s standards can be higher than those established by HUD. To qualify for an FHA loan, borrowers must have a credit score of at least 500 with 10 percent down or 580-plus to pay just 3.5 percent down. Furthermore, borrowers must have a debt-to-income ratio of 43 percent or lower, and those who put less than 20 percent down must obtain mortgage insurance. The final stipulations are that the applicant must live in the residence they're purchasing with the FHA mortgage, make enough money to pay the mortgage payments and have proof of employment/income.

You will likely pay a slightly higher interest rate, but the mortgage insurance can be canceled after you gain enough equity in your home, unlike with an FHA loan. “This is for working families of relatively modest means,” Sullivan notes. Home buyers with a credit score below 580 are required to make a 10% down payment. The down payment funds can belong to the borrower or can be a gift from a family member.

Conventional loans allow homeowners a maximum loan-to-value of 95% of the value of the home on a rate and term refinance. The maximum loan-to-value for a cash-out refinance is 85% of the value of the home for primary residence. HomeChoiceloans offer borrowers with a disability or who have a family member with a disability who may need greater underwriting flexibilities, including non-occupying co-borrowers. NerdWallet strives to keep its information accurate and up to date.

As the buyer and borrower, you will have items on your checklist that are required by your lender, the seller, and even the title company. The closing checklist covers all the fees to be paid, the information to be provided, and the disclosures to be signed before the title is conveyed to you. While FHA requirements define which closing costs are allowable as charges to the borrower, the specific costs and amounts that are deemed reasonable and customary are determined by each local FHA office. It's best to turn in your FHA loan application when you have a solid 12 months of on-time payments for all financial obligations. The most recognized 3.5% down payment mortgage in the country.

FHANewsblog.com is a private company, not affiliated with any government agency, is not a lender and does not offer to make loans. The opinions presented on FHAnewsblog.com should not be construed as representing the official opinions of any government agency. We do not offer or have any affiliation with loan modification, foreclosure prevention, payday loan, or short-term loan services.

Here’s what you need to know about the requirements to borrow an FHA loan without the government jargon and footnotes. FHANewsBlog.com is privately funded and is not a government agency. We’ll cover specific requirements for properties to be purchased with an FHA loan in future blog posts. FHA appraisal, which assesses whether a home is eligible for an FHA loan.

No comments:

Post a Comment